However, income cannot exceed ₹50 lakhs a year. It is also for those who have opted for the government’s new presumptive income scheme. ITR 4 – ITR 4 or SUGAM is for individuals, HUFs, Partnership firms that make income through business or profession.

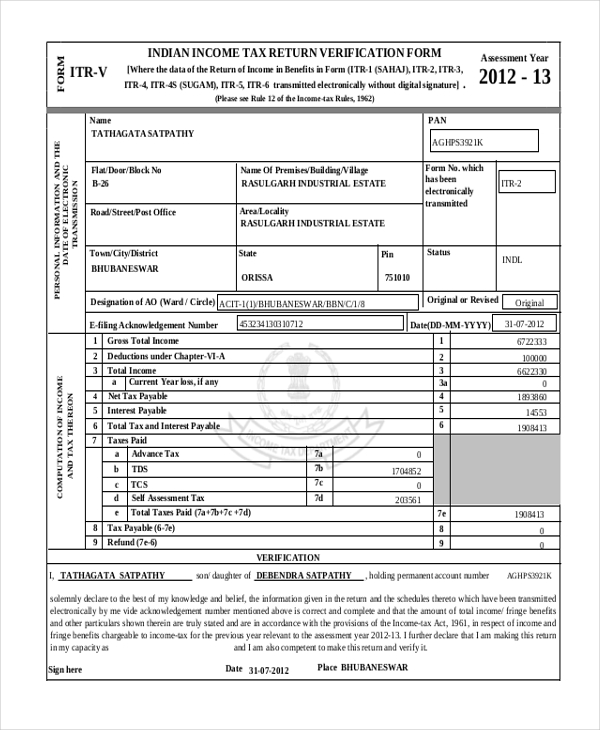

You can also include income from house property, salary, pension, and other sources in this form itself. ITR 3 – For individuals or HUFs making profits from business or profession, this is the form to use.Individuals or HUFs having a business or professional income should not use this form. ITR 2 – This form is for individuals and Hindu Undivided Families (HUF) who have income from salary, pension, house property, and other sources in excess of ₹50 lakhs.Also, your total income from all these sources should not exceed ₹50 lakhs. ITR 1 – ITR 1 or SAHAJ is the form for individuals with salaried income, income from one house property, income from other sources as well as agricultural income of up to ₹5,000.There are 7 different income tax return forms to choose from: Knowing which ITR form to choose when e-filing income tax returns are important. How to choose the right ITR form for ITR Filling With income tax return e-filing, the process is really easy. To avoid any of these hassles, it is best to pay your taxes on time. Indian tax laws allow a minimum of 3 years of imprisonment that could extend to 7 years. There is also the possibility that the IT department could launch legal action against you. It is important for individuals to file their IT returns on time because a missed payment could hamper your chances of getting a visa for travel and even mess with your loan applications. Missing this deadline will incur penalties. Usually, for individuals, the due date for filing income tax returns, manually or ITR online, is the end of July (31st) every year. It is compulsory to file your taxes if you an individual whose annual income falls within the taxable limit. Whether you do it manually or you take the e-filing income tax return does not matter. As a law-abiding citizen of India, it is mandatory to file income tax returns if your income is in the taxable bracket.

0 kommentar(er)

0 kommentar(er)